Introduction:

Whether you are looking for ca course details after 12th or curious about the scope of chartered accountant in india, this guide covers everything from ca syllabus updates to the minimum salary for chartered accountant in india

What is a Chartered Accountant (CA)?

The journey to this prestigious title involves mastering the ICAI New Scheme of Education and Training, which includes the Foundation, Intermediate, and Final examinations. A critical phase of this path is the mandatory two-year articleship, a period of rigorous practical training that ensures every CA possesses the expertise to manage complex financial landscapes—from GST regulations to international accounting standards (IFRS). Because of their deep financial insight, many CAs eventually transition into leadership roles such as CFOs or CEOs, making it one of the most rewarding career paths in the global economy.

What Does a Chartered Accountant Actually Do? (Beyond Taxes)

In today’s data-driven economy, CAs leverage AI-powered auditing tools and advanced financial modeling to predict market trends and safeguard company assets. They act as the “conscience” of a corporation, ensuring that every financial decision is not only profitable but also ethically and legally sound. Whether it’s helping a tech startup secure its first round of funding or investigating complex financial frauds, the scope of a CA’s work is vast and multidisciplinary.

Roles and Responsibilities of a Chartered Accountant

| Core Role | Responsibilities | The Long-Term Career Path |

|---|---|---|

| Auditing & Compliance | Checking bank statements, verifying bills, and ensuring the company follows Accounting Standards. | Statutory Auditor or Audit Partner at a Big 4 firm. |

| Taxation (Direct & Indirect) | Filing GST returns, calculating Income Tax, and handling basic tax audits for clients. | Tax Consultant or Advisor for International tax treaties. |

| Financial Management | Managing day-to-day cash flows, preparing Balance Sheets, and analyzing profit margins. | Finance Manager or eventually a Chief Financial Officer (CFO). |

| Business Strategy | Assisting senior CAs in preparing business plans and feasibility reports for new projects. | Management Consultant helping businesses scale or pivot. |

| Forensic Accounting | Learning to spot “red flags” in data and assisting in investigating financial frauds. | Forensic Auditor working with banks or government agencies. |

| Risk Management | Identifying potential financial losses and ensuring the business has a “Plan B”. | Chief Risk Officer (CRO) or Internal Audit Head. |

Don’t just be an accountant; be a strategist.[ See how CAs influence global business decisions] .

CA Course Details

CA Course Duration

| Course Level | Duration | Number of Papers | Passing Criteria |

|---|---|---|---|

| CA Foundation | 4–6 Months | 4 Papers | 40% per paper & 50% aggregate |

| CA Intermediate | 8–10 Months | 6 Papers (2 Groups) | 40% per paper & 50% per group |

| SPOM (Online) | Self-Paced | 4 Modules (Sets A–D) | 50% in each module |

| Articleship | 2 Years | Practical Training | Mandatory 24 months continuous |

| CA Final | 6 Months | 6 Papers (2 Groups) | 40% per paper & 50% per group |

CA Eligibility & Entry Levels (2026 Update)

CA Eligibility Criteria

| Entry Level | Educational Qualification | Marks Requirement | CA Exams Eligibility |

|---|---|---|---|

| After 12th Grade | Passed 10+2 from any stream | Passing Marks | Eligible for CA Foundation |

| After Graduation | Commerce Graduate / PG | Min. 55% | Direct Entry to CA Intermediate |

| After Graduation | Non-Commerce Graduate / PG | Min. 60% | Direct Entry to CA Intermediate |

Key Entry Details:

- Registration: You can register for the CA Foundation after Class 10, but can only appear for exams after the Class 12 boards.

- Direct Entry: Graduation allows you to skip the Foundation level, saving time for those starting late.

- Professional Entry: Students who have cleared CS Executive or CMA Intermediate are also eligible for the Direct Entry route.

and use the title “Chartered Accountant”.

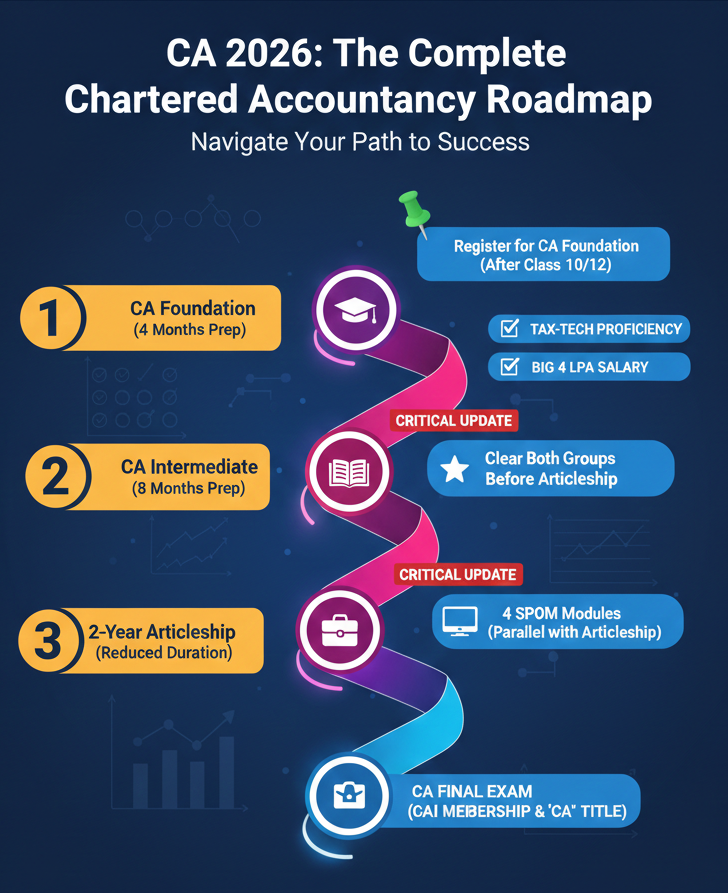

How to Become a Chartered Accountant: The 2026 Step-by-Step Roadmap

Step 1: Register with ICAI

Register for the CA Foundation course after passing your Class 10 exams. Note that your registration remains valid for four years.

Step 2: Appear for the CA Foundation Exam

You can sit for the exam after appearing for your 12th-grade boards and completing a mandatory 4-month study period. In 2026, exams are held thrice a year (January, May/June, and September).

Step 3: Enroll in CA Intermediate

After clearing the Foundation (or via Direct Entry for graduates), register for CA Intermediate. You must now study for 8 months before appearing for the exams.

Step 4: Complete ICITSS Training

Before starting your articleship, you must finish the Integrated Course on Information Technology and Soft Skills (ICITSS). This is a 4-week program covering IT and orientation.

Step 5: Clear Both Groups of CA Intermediate

Under the new 2026 rules, you must clear both groups of CA Intermediate before you can start your practical training.

Step 6: Register and Complete 2-Year Articleship

The CA articleship duration 2026 is now 2 years of continuous practical training (reduced from 3 years). You will receive a stipend that has been significantly increased under the new guidelines.

Step 7: Clear Self-Paced Online Modules (SPOM)

CRITICAL UPDATE: During your articleship, you must pass four Self-Paced Online Modules (Sets A, B, C, and D) with at least 50% marks. You cannot register for the CA Final exam without clearing these.

Step 8: Pass the CA Final Exam

After your 2-year articleship ends and you complete Advanced ICITSS, appear for the CA Final exam. You need a 6-month study period after training to sit for the finals.

Step 9: Apply for ICAI Membership

Once you pass both groups of the CA Final, you can officially apply for ICAI membership and use the title “Chartered Accountant”.

Future-Ready Skills Every CA Student Needs

-

Technical Proficiency (Tax-Tech & ERP)

Modern CA skills now require a deep understanding of digital financial ecosystems.

- ERP Systems: Proficiency in SAP, Oracle, and Microsoft Dynamics is essential for managing large-scale corporate data.

- Tax-Tech: Understanding automated tax filing software and GST portal integration helps in reducing manual errors and improving compliance speed.

-

AI Literacy & Data Analytics

Artificial Intelligence is transforming the “audit” process. Future CAs must be comfortable with:

- AI for Financial Forecasting: Using machine learning models to predict cash flow trends and market risks.

- Automated Auditing: Leveraging AI tools to scan thousands of transactions for “red flags” in seconds, a process known as Continuous Auditing.

- Data Visualization: Using tools like Tableau or PowerBI to present complex financial data to stakeholders clearly.

-

Essential Soft Skills

While technical skills get you the job, soft skills get you promoted.

- Professional Ethics: As a guardian of financial integrity, maintaining a high ethical standard is the most critical CA skill.

- Strategic Communication: The ability to explain complex tax laws or financial risks to a non-finance CEO.

- Leadership: Managing teams during the intense pressure of “audit season” or corporate mergers.

Don’t get left behind! Master the tools that top-tier firms demand [Explore 2026 upskilling courses for CA students].

Career Opportunities for Chartered Accountants

Top Career Avenues

- Public Practice: Join a CA firm (Big 4, Mid-size firms) for roles in Statutory Audit, GST Compliance, and Tax Consultancy. You can also open an Independent Practice.

- Corporate Sector: Work for MNCs or large Indian companies in Corporate Finance, managing budgets, cash flow, and financial reporting.

- Investment Banking: High-paying roles in Mergers & Acquisitions (M&A), business valuation, and equity research.

- Government Jobs & PSUs: Secure positions in regulatory bodies like the RBI and SEBI, or work in Finance/Audit for PSUs like ONGC/GAIL.

- Entrepreneurship: Leverage your expertise to launch your own Fintech startup or provide high-level “Virtual CFO” services.

- Financial Advisory: Specialize in niche areas like Risk Management and Forensic Accounting (investigating fraud).

CA Salary in India (2026 Trends)

| Experience Level | Average Annual Package (LPA) | Highest CA Salary (LPA) | Top Hiring Sectors |

|---|---|---|---|

| Fresher (CA Newbie) | ₹9 – ₹14 LPA | ₹26.6 LPA (PSU) | Big 4, PSU, & Startups |

| Mid-Level (3–5 Years) | ₹18 – ₹30 LPA | ₹45 LPA+ | MNCs & Investment Banking |

| Senior (10+ Years) | ₹40 – ₹70 LPA | ₹1 Crore+ (CFO/Partner) | Global Corporations |

Verified Source – AmbitionBox

Planning your financial future? [Explore the highest-paying CA job roles and salary trends for 2026] to see what you could be earning.

CA vs. CS (Accounting vs. Law)

| Particulars | Chartered Accountancy (CA) | Company Secretary (CS) |

|---|---|---|

| Primary Focus | Auditing, Taxation, & Finance | Corporate Law & Governance |

| Duration | ~4 Years (Inc. 2-yr Articleship) | 3 – 4 Years |

| Total Reg. Fees | Approx. ₹50,000 (Foundation to Final) | Approx. ₹25,000 – ₹30,000 |

| Entrance Exam | CA Foundation | CSEET |

| Avg. Salary 2026 | ₹10.8 – ₹14 LPA | ₹7 – ₹9 LPA |

| Top Recruiters | Big 4 (EY, PwC, Deloitte, KPMG) | HCL, Birla Corp, Reliance, Omaxe |

Why Most Students Fail (And Tips to Pass the CA Exams)

Under the ICAI New Scheme 2026, the focus has shifted toward conceptual clarity. Students who rely on “rote learning” often struggle, while those who understand the “why” behind the laws and standards succeed.

The CA Success Checklist: Your Roadmap to Passing

- Consistent 8-10 Hour Routines: It’s not about how many days you study, but how many hours you are focused. Consistency is the only way to cover the massive syllabus.

- Master the ICAI Study Material: Google and toppers agree—ICAI’s own modules are the “Bible.” Never skip them for private coaching notes.

- Solving MTPs & RTPs: You must solve at least two years of Mock Test Papers (MTPs) and Revision Test Papers (RTPs). This familiarizes you with the 2026 exam pattern and improves your speed.

- Write While You Study: Don’t just read. Practicing “written papers” helps with muscle memory for the actual 3-hour exam.

- Prioritize Mental Health: CA exam stress is real. Include 30 minutes of physical activity or meditation in your daily schedule to avoid burnout.

Conclusion

11. FAQs

The Chartered Accountant (CA) qualification is a prestigious professional designation in accounting, auditing, and taxation. Regulated by the Institute of Chartered Accountants of India (ICAI), it is awarded to individuals who pass three levels of examinations and complete two years of mandatory practical training (articleship).

Modern CAs use advanced ERP and Tax-Tech tools to ensure financial accuracy. The most popular software includes TallyPrime, SAP, Oracle NetSuite, and Microsoft Dynamics 365. For specialized tasks, they use audit tools like CaseWare and tax compliance software like Winman or Computax.

In 2026, the average salary for a fresher CA typically ranges from ₹10 LPA to ₹14 LPA. According to AmbitionBox, top-tier candidates and rank holders placed in Big 4 firms or Investment Banking can secure starting packages exceeding ₹20 LPA.

Under the ICAI New Scheme, the CA course duration is approximately 42 to 48 months. The total ICAI registration and exam fees for all levels (Foundation, Intermediate, and Final) amount to roughly ₹75,000 to ₹85,000, excluding private coaching costs.

The total mandatory cost of pursuing the CA course is between ₹75,000 and ₹1,00,000. This covers registration, study modules, exam forms, and mandatory ICITSS/Advanced ICITSS training. If a student opts for private coaching, the total expense may increase by ₹1.5 lakh to ₹3 lakh.

Don’t navigate the roadmap alone. Contact our mentors for a free session to plan your CA career strategy!